Investing in VidAngel Entertainment, Inc. would come with significant risks and you could lose some or all of your investment. There are no guarantees of revenues, returns, or profitability.

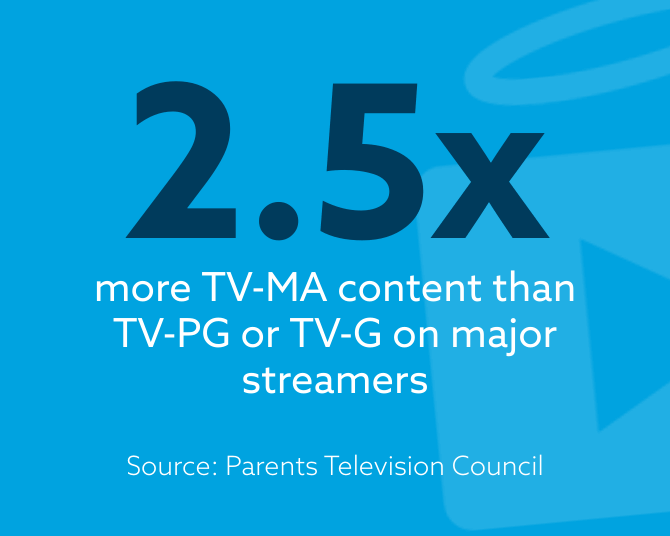

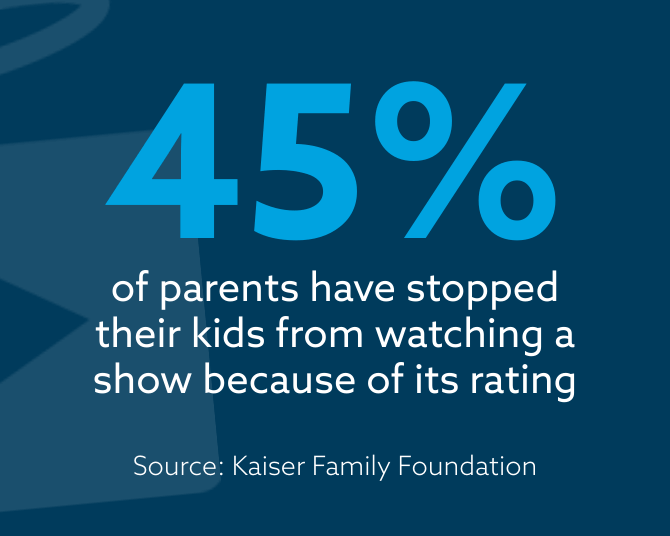

Streaming is massive. So is the junk people have to skip through to enjoy it. Somehow, an industry built on family entertainment decided families don't matter anymore. Plot twist: they do.

We're offering you the chance to own part of the solution. Real shares. Real ownership. Real opportunity to benefit while helping to make entertainment better for families everywhere.

We’re building a next-generation platform that goes beyond filtering and empowers individuals and families to navigate today’s media landscape and stream with confidence.

With these new experiences, and more to come, we’re eliminating the guesswork and worry from streaming, giving you the confidence that what you watch is good for your home.

VidAngel is offering a unique investment opportunity.

This would be done with accredited investors via a Reg D 506(c) offering to accelerate:

An investment in VidAngel is subject to significant risks, including the risk of complete loss of principal. You should only invest as much as you are willing, and can afford, to lose, and only after you have read and understood our offering documents (including the risk factors in the Private Placement Memorandum) linked above.

THESE OFFERING MATERIALS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Investing in VidAngel Entertainment, Inc. would come with significant risks and you could lose some or all of your investment. There are no guarantees of revenues, returns, or profitability.